Are you tired of living paycheck to paycheck? Maybe you're drowning in debt or just starting to think about how to take control of your finances. If so, you’ve probably heard about Dave Ramsey’s baby steps. These seven key actions offer a straightforward way to get your money under control, get rid of debt, and build real wealth over time. The best part? They’re easy to follow, no finance degree required.

Whether you're just getting started or you're already a few steps in, Ramsey’s approach is built to help regular folks take charge of their financial lives. No complicated jargon, no wild get-rich-quick schemes—just simple, doable actions that stack up over time.

So, if you're ready to stop stressing about money and start building a better financial future, stick around. This guide walks you through each of Dave Ramsey’s baby steps, explains why they matter, and gives you practical tips on how to make them work for you.

Table of Contents

- What Is Dave Ramsey Baby Steps?

- Dave Ramsey Baby Steps: Step-by-Step Breakdown

- Real-World Tips for Success

- Frequently Asked Questions

- Final Thoughts

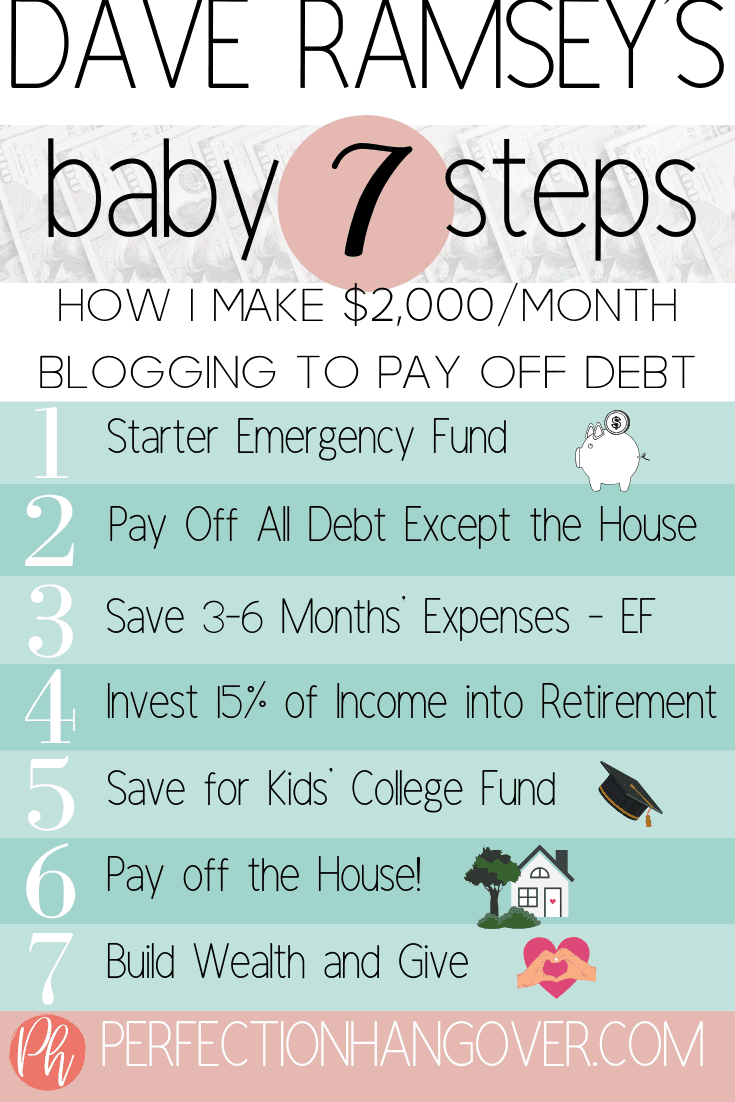

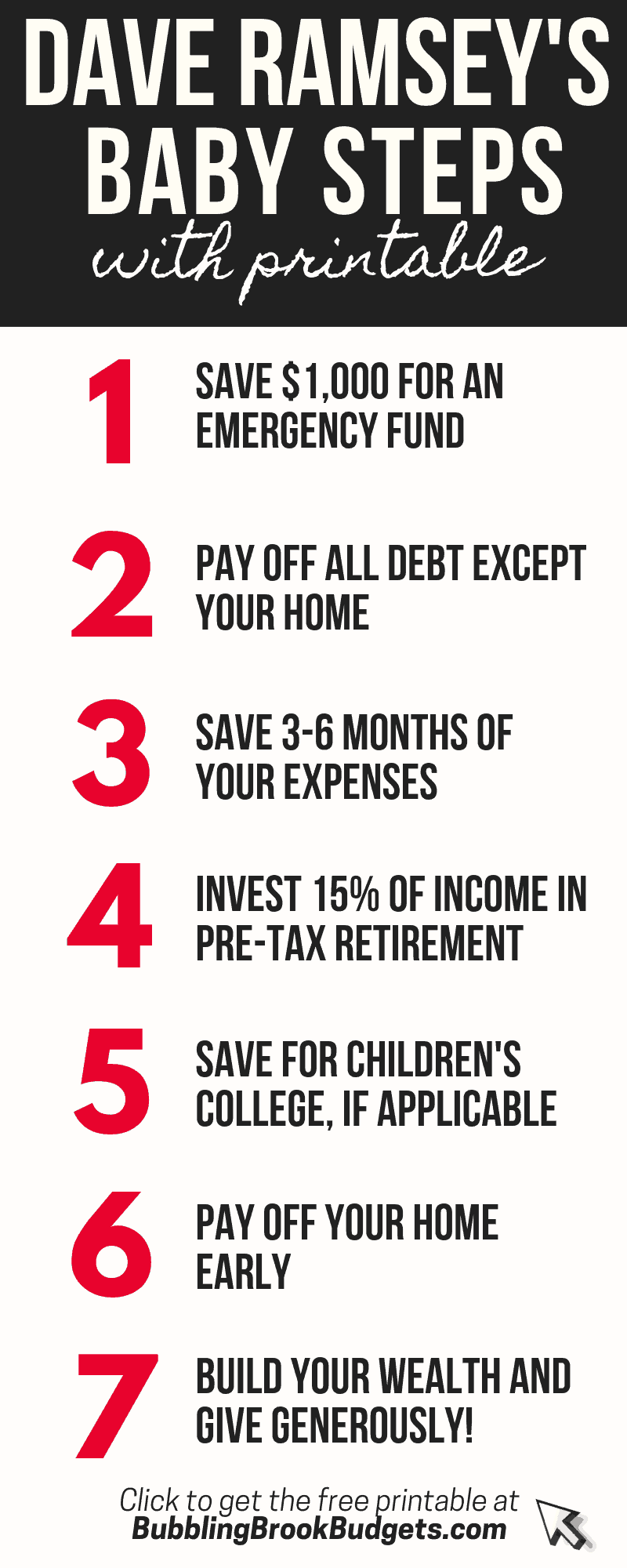

What Is Dave Ramsey Baby Steps?

Dave Ramsey’s baby steps are a set of seven financial actions designed to help people get out of debt, build an emergency fund, and grow long-term wealth. Each step builds on the one before it, so you don’t jump ahead until you’ve fully completed the previous one.

Unlike some financial systems that feel too complex or out of reach, Ramsey’s baby steps are built around simplicity and consistency. They’re not a shortcut—they’re more like a solid foundation you build brick by brick. That’s why so many people find them helpful, especially if you’re just getting started with managing your money.

Dave Ramsey Baby Steps: Step-by-Step Breakdown

Here’s a simple breakdown of each baby step, along with what you need to know to follow them effectively:

Step 1: Save $1,000 for a Starter Emergency Fund

Your first goal is to set aside $1,000 as a safety net. This fund is meant to cover small, unexpected expenses—like a car repair or a medical bill—without needing to use a credit card.

How do you start? Look at your monthly budget and see how much you can set aside each week. Even $20 a week adds up. Keep this money in a separate savings account so you can access it quickly, but not so easily that you’re tempted to use it for everyday spending.

Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

Once you’ve got that $1,000 emergency fund, it’s time to tackle debt. Ramsey recommends using the debt snowball method, which means paying off your smallest debts first while making minimum payments on the rest.

Let’s say you have a $200 credit card balance, a $500 medical bill, and a $3,000 personal loan. You’d pay off the $200 card first, then the $500 bill, and so on. This gives you small wins that keep you motivated to keep going.

Step 3: Save 3–6 Months of Expenses in Your Emergency Fund

Now it’s time to grow your emergency fund to cover 3–6 months of living expenses. This gives you more security in case of a job loss, major medical issue, or other big life event.

Depending on your job stability and family situation, aim for at least three months, but six is better. Think of this as your financial seatbelt—it’s not fun to use, but you’ll be glad you have it if something goes wrong.

Step 4: Invest 15% of Your Income for Retirement

Once your emergency fund is solid and your debt is gone, it’s time to start thinking about the future. Ramsey suggests putting 15% of your household income into retirement accounts like a 401(k) or Roth IRA.

This step helps you build long-term wealth and ensures you’re not just surviving in the present, but also planning for a secure future.

Step 5: Save for Your Kids’ College Fund

If you have children and plan to help them with college, this is the step where you start saving for that. Ramsey suggests using a 529 plan or another college savings account to help grow the money tax-free.

Keep in mind: this step comes after retirement savings. You can borrow for college, but not for retirement, so don’t skip step 4 to fund step 5.

Step 6: Pay Off Your Home Early

Once all other financial goals are met, you can focus on paying off your mortgage ahead of schedule. This gives you peace of mind and eliminates one of the biggest monthly expenses for most families.

You can do this by making extra payments each month or switching to biweekly payments. Just make sure there’s no prepayment penalty on your mortgage before you start.

Step 7: Build Wealth and Give Generously

At this stage, you’re not just surviving—you’re thriving. The final baby step is about building generational wealth and giving back. Whether it’s investing more, starting a business, or supporting causes you care about, this step is about living with purpose and freedom.

It’s a reminder that financial success isn’t just about how much you have—it’s about how you use it to impact the world around you.

Real-World Tips for Success

Following the baby steps takes time and discipline, but a few smart strategies can make the process smoother:

- Set small goals: Breaking each step into smaller milestones keeps things manageable.

- Track your spending: Use a budgeting app or spreadsheet to see where your money is going each month.

- Automate savings: Set up automatic transfers to your emergency fund or retirement accounts to stay consistent.

- Stay patient: These steps take months or even years to complete. Don’t get discouraged if progress feels slow.

- Get support: Share your journey with friends or family. Better yet, find a local Dave Ramsey group for encouragement and accountability.

You can also check out more financial tools and resources at our site. Learn more about how to build a better budget and stay on track with your baby steps journey.

Frequently Asked Questions

Can I Skip a Baby Step?

It’s best to follow the baby steps in order. Each one builds on the previous one, so skipping ahead might leave gaps in your financial foundation. For example, you wouldn’t start investing for retirement before paying off debt—doing so could cost you more in interest over time.

What If I’m Already Retired?

If you’re already retired or close to retirement, some steps might not apply the same way. For instance, saving for your kids’ college fund or paying off your house might not be top priorities. Adjust based on your life stage, but the core principles—like having an emergency fund and staying out of debt—still apply.

Do the Baby Steps Work for Low-Income Families?

Absolutely. The baby steps are designed to work for people at all income levels. It might take longer to build an emergency fund or pay off debt if you’re starting with less, but the process is the same. Small, consistent actions over time can make a big difference.

Final Thoughts

Dave Ramsey’s baby steps aren’t a get-rich-quick scheme—they’re a roadmap to long-term financial stability. Whether you’re just starting out or already on the path, each step gets you closer to peace of mind and freedom from debt. The key is to stay consistent, keep learning, and celebrate every small win along the way.

If you're ready to take control of your finances, start with step one. Even a $100 saved or a single small debt paid off is progress. For more tips and tools, be sure to explore our other guides on personal finance and budgeting.

Detail Author:

- Name : Trystan Mraz PhD

- Username : uparker

- Email : olarkin@hotmail.com

- Birthdate : 2004-04-19

- Address : 593 Ken Squares Apt. 944 Sauerton, SD 35843

- Phone : +1 (731) 773-5157

- Company : Corwin-Cronin

- Job : Choreographer

- Bio : Quia suscipit et facere. Distinctio quasi eligendi aut id recusandae enim debitis est. Ut nulla nulla rerum ratione expedita voluptates. Est iusto ex sequi voluptatem.

Socials

tiktok:

- url : https://tiktok.com/@allen.bergstrom

- username : allen.bergstrom

- bio : Veniam animi molestias et consequuntur et velit.

- followers : 122

- following : 886

instagram:

- url : https://instagram.com/abergstrom

- username : abergstrom

- bio : Sunt omnis aliquam eum voluptas. Non nulla tenetur maiores. Fuga natus quibusdam sit molestias.

- followers : 557

- following : 2268

twitter:

- url : https://twitter.com/bergstrom2008

- username : bergstrom2008

- bio : Impedit tempora hic at perferendis ducimus non. Aperiam magni repellendus voluptatem aut ipsa labore.

- followers : 5106

- following : 1996

linkedin:

- url : https://linkedin.com/in/abergstrom

- username : abergstrom

- bio : Atque nulla esse et dolorem.

- followers : 5603

- following : 2500